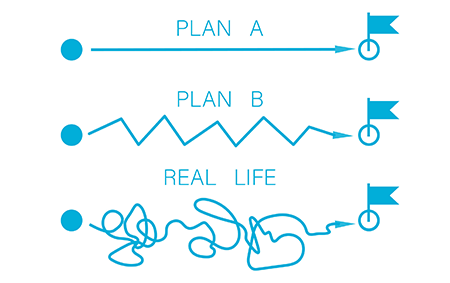

If the truth be told, we are always in transition of some sort. The world changes – and quickly. Yet there are several common points in life that point to the need to rethink fundamental things. And your approach to money is one of those things.

Whether you are taking on new roles in your career or in your home, entering or exiting a relationship, approaching retirement, or inheriting funds from a loved one… transitions can be stressful. Each of these things changes “your world,” and your financial decisions likely need to adapt. We are prepared to meet you in these places and become the sounding board and guide you need to ensure your wealth is aligned with your values as life evolves.

Our focus is centered on you. We want to know what’s in your head and your heart as much as what is on your balance sheet. This allows us to deliver planning that is tailored to your unique needs. With the busy life you lead, we understand that time is precious. We take a holistic view to ensure all areas of planning are considered in a coordinated way. From retirement, investments, tax, insurance and estate plan to providing for a special needs child or favorite charity… we support you so you can focus your time and energy on your career and family with the confidence that your plan is on track.